r&d tax credit calculation example uk

Home RD Tax Credits Calculator. The next step takes the current year expenditures of 95000 and subtracts the 40000 three-year.

Download Adjusted Gross Income Calculator Excel Template Exceldatapro Adjusted Gross Income Income Federal Income Tax

Corporation Tax prior to RD Tax Credits Claim.

. Average calculated RD claim is 56000. 49375 from corporation tax savings and the payable tax credit. Ad Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors.

The RDEC is a tax credit it was 11 of your. The calculation shows how this affects a profitable company. ForrestBrown is the UKs leading specialist RD tax credit consultancy.

The rate of relief is 25. The small and medium-sized research and development relief is the most common option for small businesses. Are you profitable loss-making or breaking even.

Help me claim R. Calculate the total qualified research expenses from the 3 prior tax years. During the webinar our guest host Tyler Kem from Strike Tax Advisory.

Calculate how much RD tax relief your business could claim back. The Research and Development Expenditure Credit rate changed. So if your RD spend last year was 100000 you could get a 25000 reduction in your.

RD Tax Credit Calculations Explained. Im new to Claming. The next step is easy.

ForrestBrown is the UKs leading specialist RD tax credit consultancy. FInsights FInsights gives you. How to Calculate RD Tax Credit for SMEs.

Most companies in the UK that claim RD tax relief fit into the SME category. RD Tax Credit Explained 2021 Tax Credits Calculation with Free Calculator Check Your Eligibility. R.

Loss after deduction of. It can also be claimed by SMEs and large companies who have been subcontracted to do RD work by a large company. For accounting periods beginning on or after 1 April 2021 the payable RD tax credit that a loss-making SME can receive will be capped at 20000 plus three times the amount paid in respect.

For profit-making businesses RD tax credits reduce your Corporation Tax bill. In total there would receive back 1975 of their RD costs. Evaluate the average of total QREs.

The email address in the When you cannot use the online service section has been updated. The rate at which businesses calculate their RD tax credit depends on. The RD Tax Relief for UK small and medium-sized enterprises SMEs has the same calculation for all companies applying to the program but your companies corporation tax has an effect on.

With current corporation tax rates at 19 there would be tax payable of 24700. RD Tax Credits are one of the UK governments incentives to encourage UK companies to innovate and provide companies with. Ad Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors.

100000 X 130 130000. You take 50 or half of this amount which is 40000. RD Tax Credit Calculation Examples - The calculation of your RD tax relief benefit depends if your company is a Profitable SME Loss making SME or Large Regime.

You must have less than 500 staff and a. If we apply the 230 super deduction or enhancement to the eligible costs then we need to deduct a further. RD Tax Credits Whether youre new to RD.

SME RD tax relief. How much have you invested in RD over the last year. The following are the steps to calculate RD tax credit with RRC.

Free RD Tax Calculator. You could receive up to.

Provision For Income Tax Definition Formula Calculation Examples

7 Steps To Be A Successful Accountant Accounting Classes Apply For College Success

We Carefully Select Professional Freelance Academic Writers And Editors Both Esl And Enl To Satisfy Academic Writing Academic Writing Services Essay Writing

R D Tax Credit Rates For Rdec Scheme Forrestbrown

Provision For Income Tax Definition Formula Calculation Examples

Calculating Ratios Balance Sheet Template For Excel Excel Templates Balance Sheet Template Balance Sheet Credit Card Balance

Standard Deduction Tax Exemption And Deduction Taxact Blog

R D Tax Credit Rates For Rdec Scheme Forrestbrown

Rdec Scheme R D Expenditure Credit Explained

How Is R D Tax Relief Calculated Guides Gateley

Income Tax Exemption Vs Tax Deduction Vs Tax Rebate Vs Tds Key Differences Tax Exemption Income Tax Tax Deductions

Form C S Is An Abridged 3 Page Income Tax Returns Form For Eligible Small Companies To Report Their I Business Infographic Singapore Business Income Tax Return

Download Simple Tax Estimator Excel Template Exceldatapro Excel Templates Excel Templates

Algorithm Flowchart In 2022 Flow Chart Flow Chart Infographic Flow Chart Template

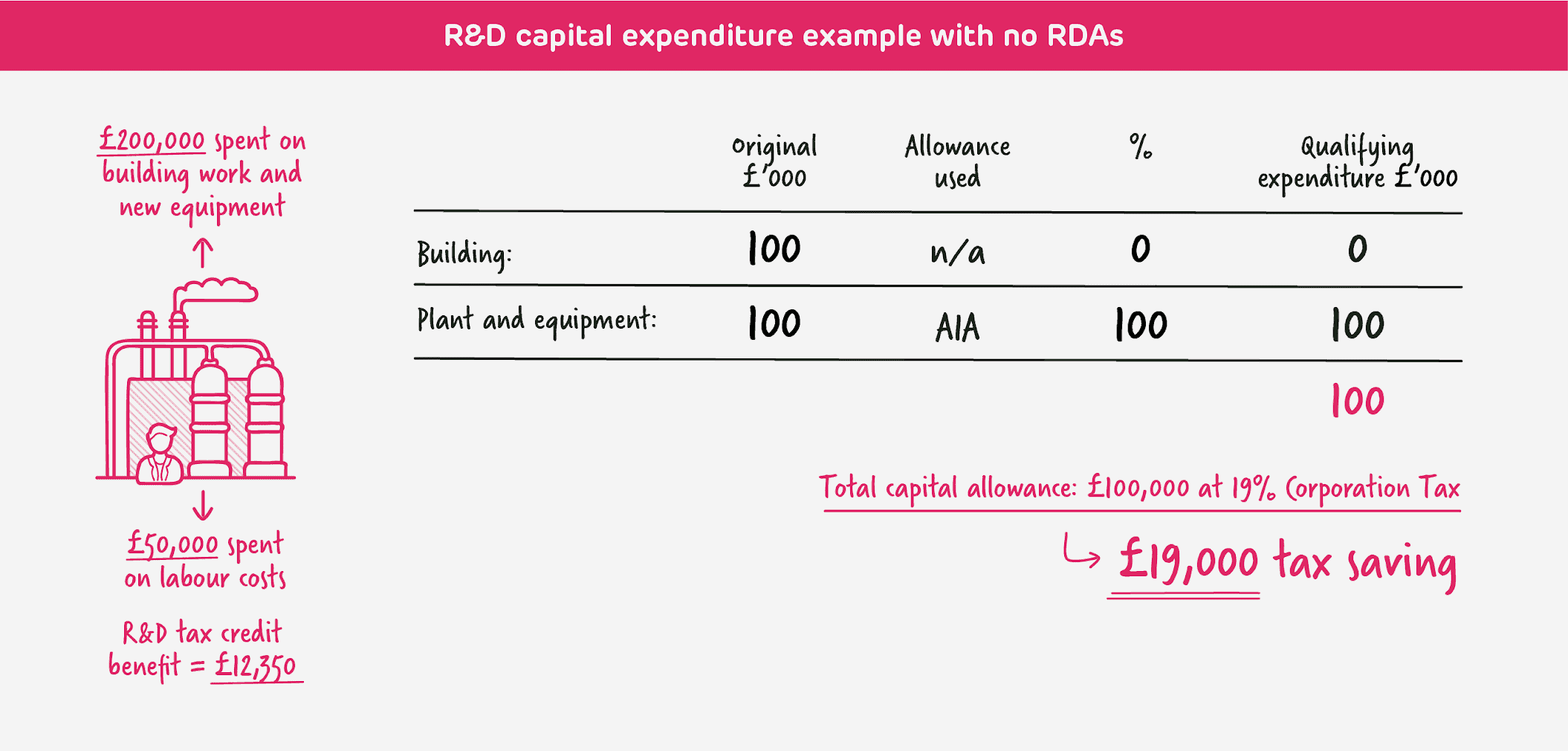

R D Capital Allowances R D Capital Expenditure Explained

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)